marin county property tax rate 2021

Our talented team will do everything possible to provide a great rental experience. State of LouisianaWith a population of 383997 according to the 2020 US.

What Is The Sales Tax In The City San Rafael

In 1886 one such taxation dispute arose between Santa Clara County and Southern Pacific Railroad.

. Median Annual Real Property Tax Payment. South Carolina has one of the lowest median property tax rates in the United States with only five states collecting a lower median property tax than South Carolina. The Annual Plan is available for public review as of July 15 2022 on the Marin County Housing Authority website at.

Southern California Summit Forum San Diego CA May 2-3 2022. HR Block Maine License Number. The companys revenue and payment volume tripled from the start of the pandemic as the world rotated overnight towards e-commerce the Collison brothers memo said.

The exact property tax levied depends on the county in Florida the property is located in. New Jerseys median income is 88343 per year so the median yearly property. Nueva Orleans is a consolidated city-parish located along the Mississippi River in the southeastern region of the US.

Tax amount varies by county. Marin County Housing Authority. Harris County has one of the highest median property taxes in the United States and is ranked 152nd of the 3143 counties in order of median property taxes.

Lucie County has one of the highest median property taxes in the United States and is ranked 362nd of the 3143 counties in order of median property taxes. Every guest transient occupying any short-term rental for any period less than 30 days is required to include TOT with the rent payment. Tax amount varies by county.

The research process is already complex even without the burden of switching between platforms. Benton County collects the highest property tax in Arkansas levying an average of 92900 06 of median home value yearly in property taxes while Calhoun County has the lowest property tax in the state collecting an average tax of 27500 053 of. The exact property tax levied depends on the county in Arkansas the property is located in.

New Orleans ˈ ɔːr l i ə n z OR-leeənz ɔːr ˈ l iː n z or-LEENZ locally ˈ ɔːr l ə n z OR-lənz. The median property tax in New York is 123 of a propertys assesed fair market value as property tax per year. Pennsylvania is ranked 13th of the 50 states for property taxes as a percentage of median income.

Midwest Summit Forum Cleveland OH April 18-19 2022. The railroad thought the tax code was misapplied to some of their property and assets. Harris County collects on average 231 of a propertys assessed fair market value as property tax.

The rate is 10 of the rent charged in unincorporated Marin County effective January 1 2019. Louis County Missouri is 2238 per year for a home worth the median value of 179300. The rate increased to 14 for West Marin short-term rentals and 4 for campgrounds.

Expanded Child Tax Credit available only through the end of 2022 The expansion of the Child Tax Credit was made for just one year and will be reduced back to 2000 per child in 2023. Florida Summit Forum. Miami-Dade County collects the highest property tax in Florida levying an average of 102 of median home value yearly in property taxes while Dixie County.

2021 HRB Tax Group Inc. Allegheny County has one of the highest median property taxes in the United States and is ranked 259th of the 3143 counties in order of. New York has one of the highest average property tax rates in the country with only three states levying higher property taxes.

Orange County collects on average 056 of a propertys assessed fair market value as property tax. Louis County collects on average 125 of a propertys assessed fair market value as property tax. The median property tax in Orange County California is 3404 per year for a home worth the median value of 607900.

Chester County collects the highest property tax in Pennsylvania levying an average of 125 of median home value yearly in property taxes while. Massachusettss median income is 83915 per year so the median. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes.

The median property tax in St. La Nouvelle-Orléans la nuvɛlɔʁleɑ Spanish. Fort Bend County collects on average 248 of a propertys assessed fair market value as property tax.

Allegheny County collects on average 222 of a propertys assessed fair market value as property tax. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200.

Here are the California real property tax rates by county. The exact property tax levied depends on the county in Pennsylvania the property is located in. The median property tax in New Jersey is 189 of a propertys assesed fair market value as property tax per year.

The median property tax in Fort Bend County Texas is 4260 per year for a home worth the median value of 171500. New Yorks median income is 74777 per year so the median yearly property. News on Japan Business News Opinion Sports Entertainment and More.

South Carolinas median income is 52001 per year so the median yearly property. Lucie County Florida is 2198 per year for a home worth the median value of 177200. Orange County has one of the highest median property taxes in the United States and is ranked 119th of the 3143 counties in order of median property taxes.

The median property tax in Harris County Texas is 3040 per year for a home worth the median value of 131700. Marin county property management for quality tenants in quality homes. Persons wishing to submit written comments during the 45-day public review and comment period may mail them postmarked no later than August 29 2022 to the following address.

Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes. That is nearly double the. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

The median property tax in St. The property tax rate in the county is 078. Thats why libraries turn to Ebook Central for their ebook needs.

The median property tax in Massachusetts is 104 of a propertys assesed fair market value as property tax per year. The median property tax in South Carolina is 68900 per year05 of a propertys assesed fair market value as property tax per year. In deciding the case a unanimous court ruled that governments must abide by the same tax code enforcement for individuals that it did for corporations.

Average Effective Real Property Tax Rate. Fort Bend County has one of the highest median property taxes in the United States and is ranked 57th of the 3143 counties in order of median property taxes. Stripe in March 2021 raised a 600 million venture round at a 95 billion valuation making it one of the most valuable startups in the world.

Tax amount varies by county. See terms and conditions for details. Lucie County collects on average 124 of a propertys assessed fair market value as property tax.

Neither HR Block nor. Ebook Central brings content from virtually every publisher into one unified experience so students and faculty can quickly learn the platform and easily discover and use the ebook content they need. Massachusetts has one of the highest average property tax rates in the country with only five states levying higher property taxes.

Florida is ranked 18th of the 50 states for property taxes as a percentage of median income.

Attom Data Solutions Releases 2020 Property Tax Analysis Rismedia

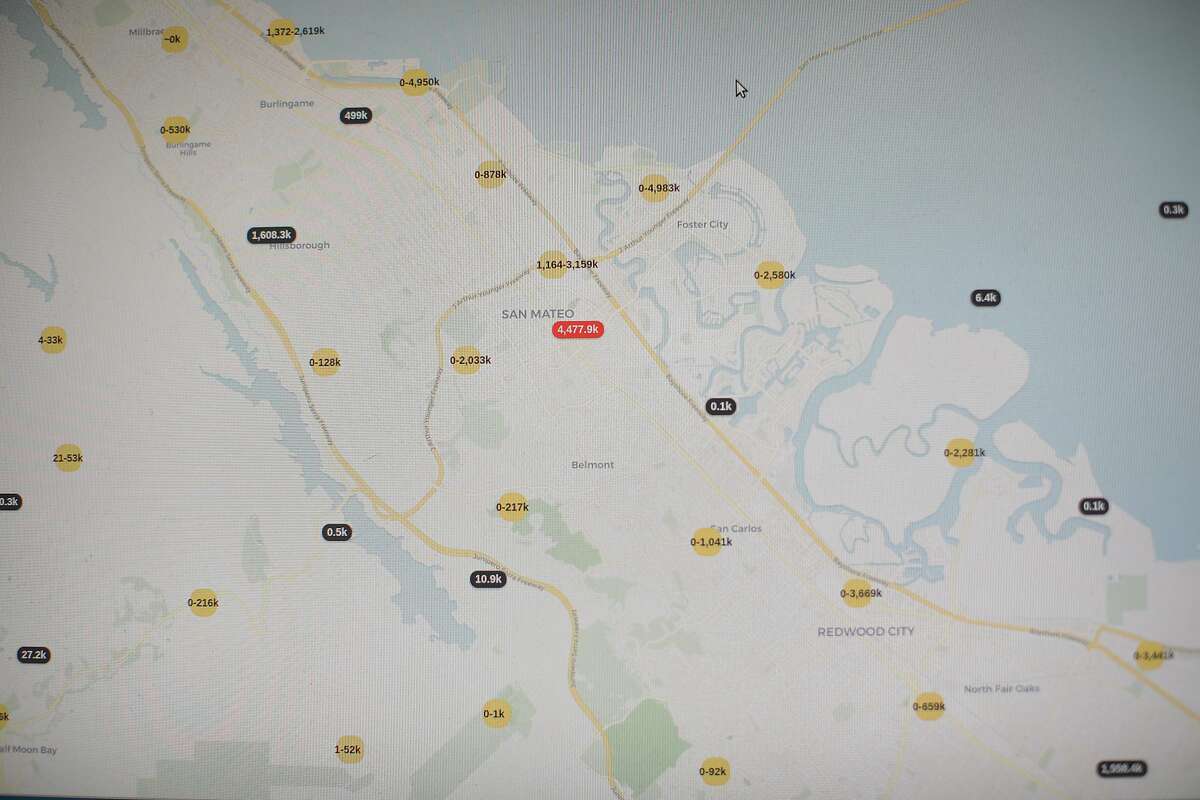

Interactive Map Shows How Much Property Tax Most Californians Pay Compared With Neighbors

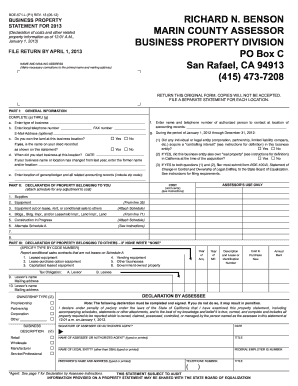

Form 571 L Marin County Fill Out And Sign Printable Pdf Template Signnow

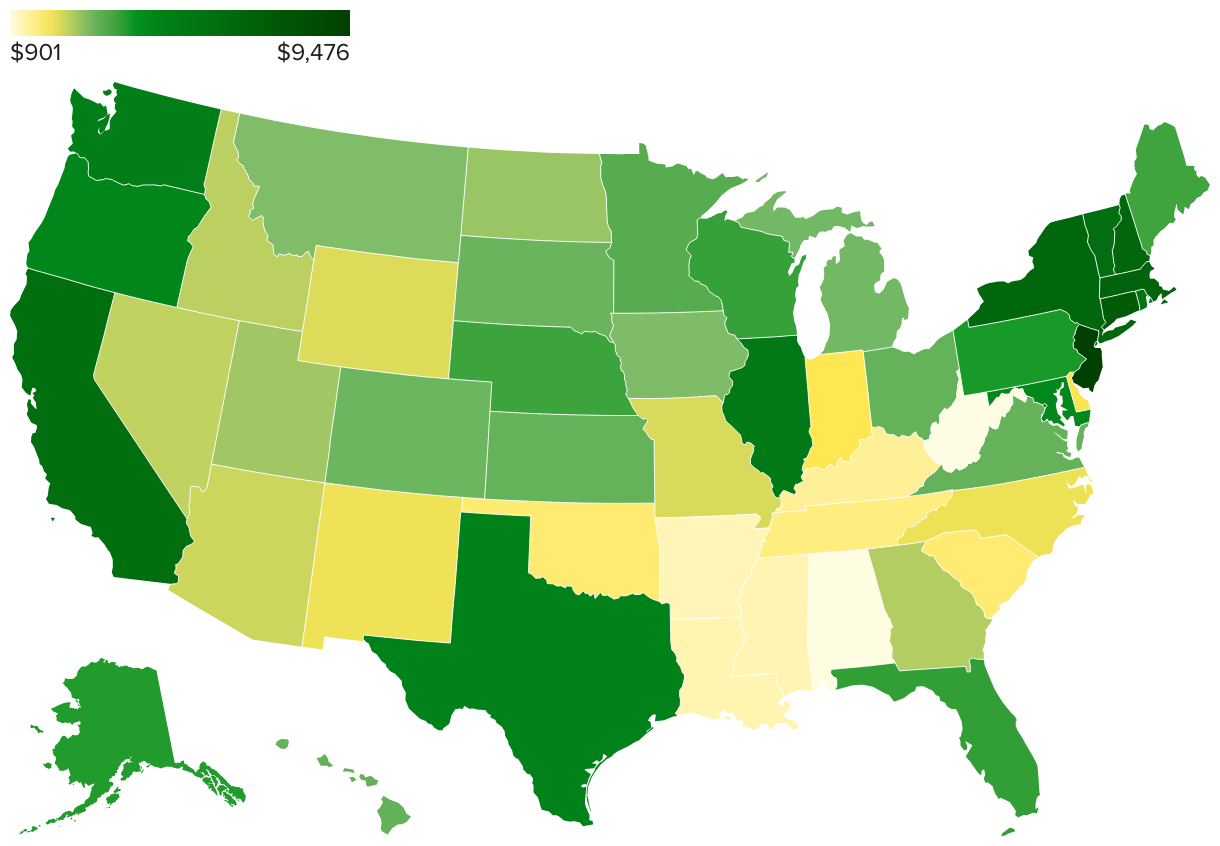

New Jersey Had Highest Property Taxes Across The U S In 2016 Mansion Global

Marin Library System Seeks Parcel Tax Hike Amid Rising Costs

Property Tax California H R Block

Property Tax Bills On Their Way

Marin County Dry Cleaner Launder Agency Establishment In Kentfield California Bizbuysell

Reusable Foodware Ordinance Community Development Agency County Of Marin

Marin Wildfire Prevention Authority Measure C Myparceltax

New California Law Adds To Prop 19 Rush For North Bay Property Tax Transfers

Property Tax Property Taxes Were Up 5 4 On Average In 2020 Fortune

Marin Economic Forum Mef Blog Marin Economic Forum

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

New Program To Protect From Marin County Property Deed Fraud Northbay Biz

Here S How Much Americans Pay In Property Taxes In Every U S State Cbs News

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Property Taxes Topped 10 000 In 12 New York Counties In 2021 Bloomberg