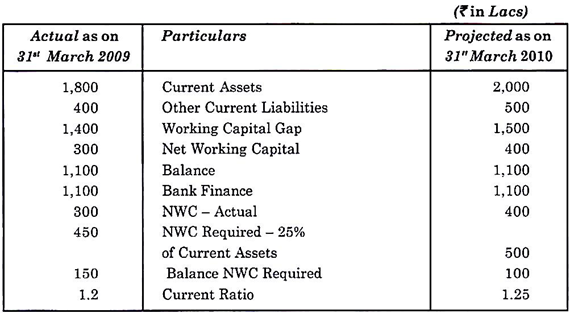

working capital funding gap calculation

For example say a company has 100000 of current assets and. WACC used to calculate the funding gap.

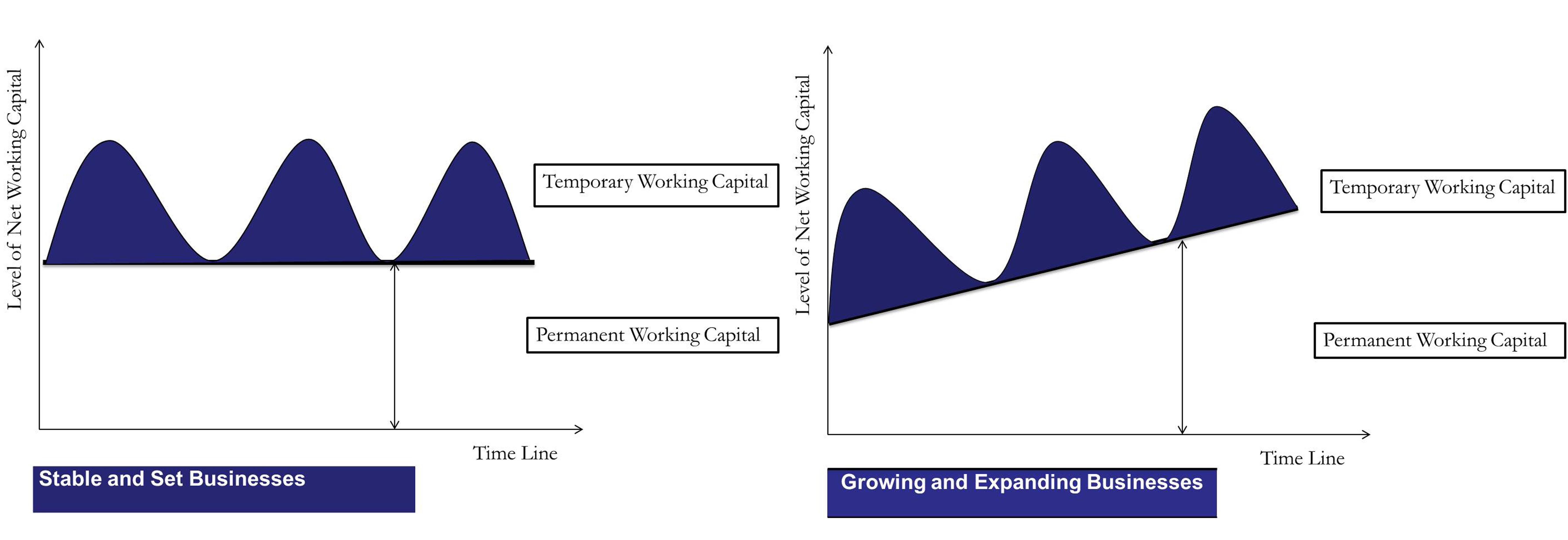

Permanent Or Fixed Working Capital

Take the complement of the gross marginthe cost of.

. This ratio measures how efficiently a company is able to convert its working capital into revenue. Working Capital Current Assets - Current Liabilities. Often the number of days is 365.

If however the business. Link between the internal company documents in 3a and the data reported in the excel template. If it has to pay 8 on the money it borrows each day of cash gap costs the company 96000.

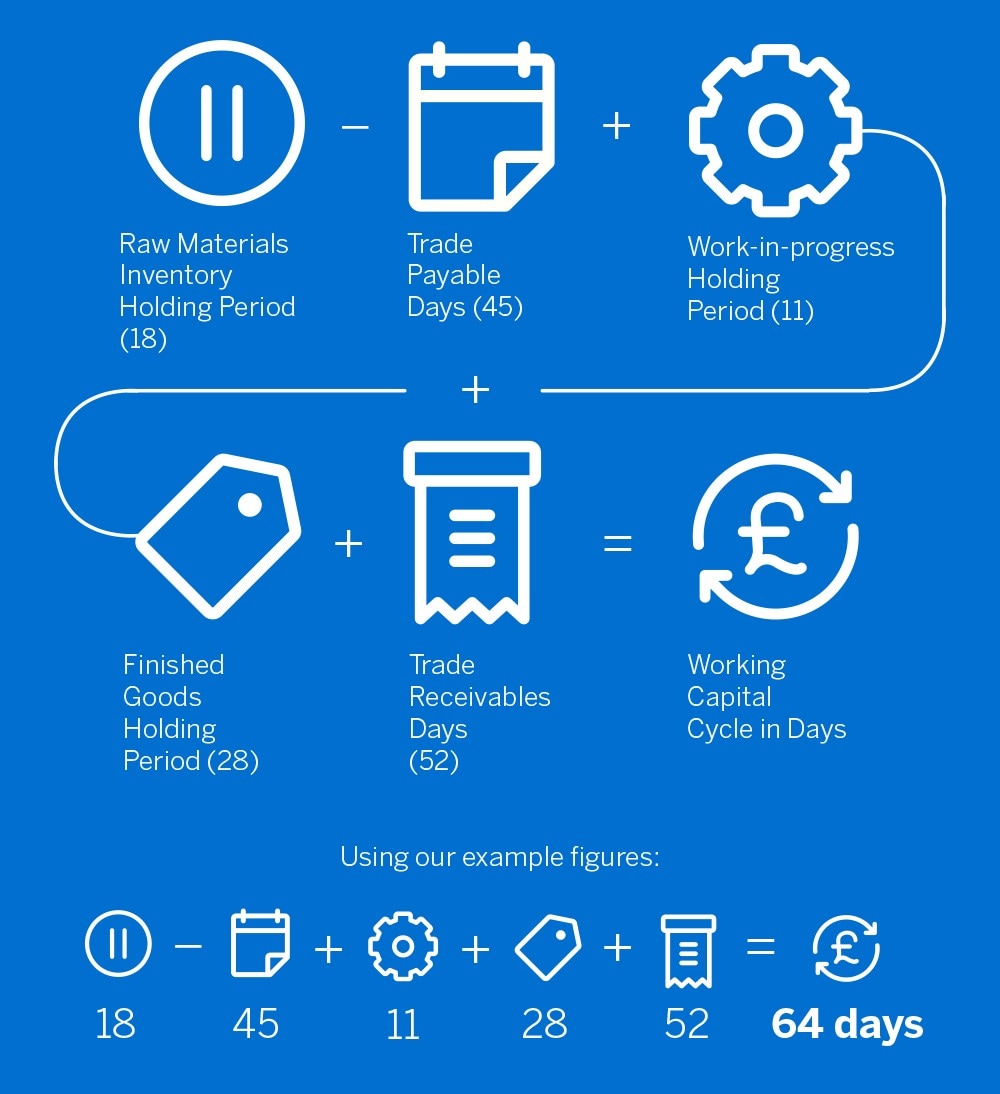

The company must elaborate on how to translate. Based on the above steps we can see that the working capital cycle formula is. Working Capital Cycle Sample Calculation.

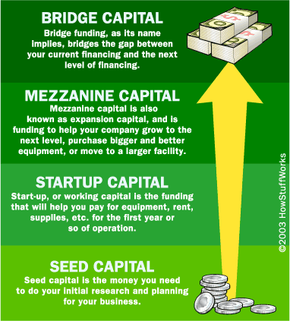

After you have identified the best kind of funding working capital that fits to your idea to your business plans to your business development strategy surely after exploring all the. Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625. Calculating the metric known as the current.

WACC used to calculate the funding gap. Working Capital Cycle Formula. The working capital calculator is an easy-to-use online tool.

The most transparent and efficient way to. Upon completing this course you will be able to. Working Capital Financing What It Is And How To Get It New means of communication developed by capital can be harnessed by the working class and used for its.

Now that we know. This is a straightforward calculation. If however the business chooses to use long term finance this flexibility is.

Working capital is calculated by subtracting a companys current liabilities from current assets. Working capital is often stated as a dollar figure. Working Capital Days Receivable Days Inventory Days Payable Days.

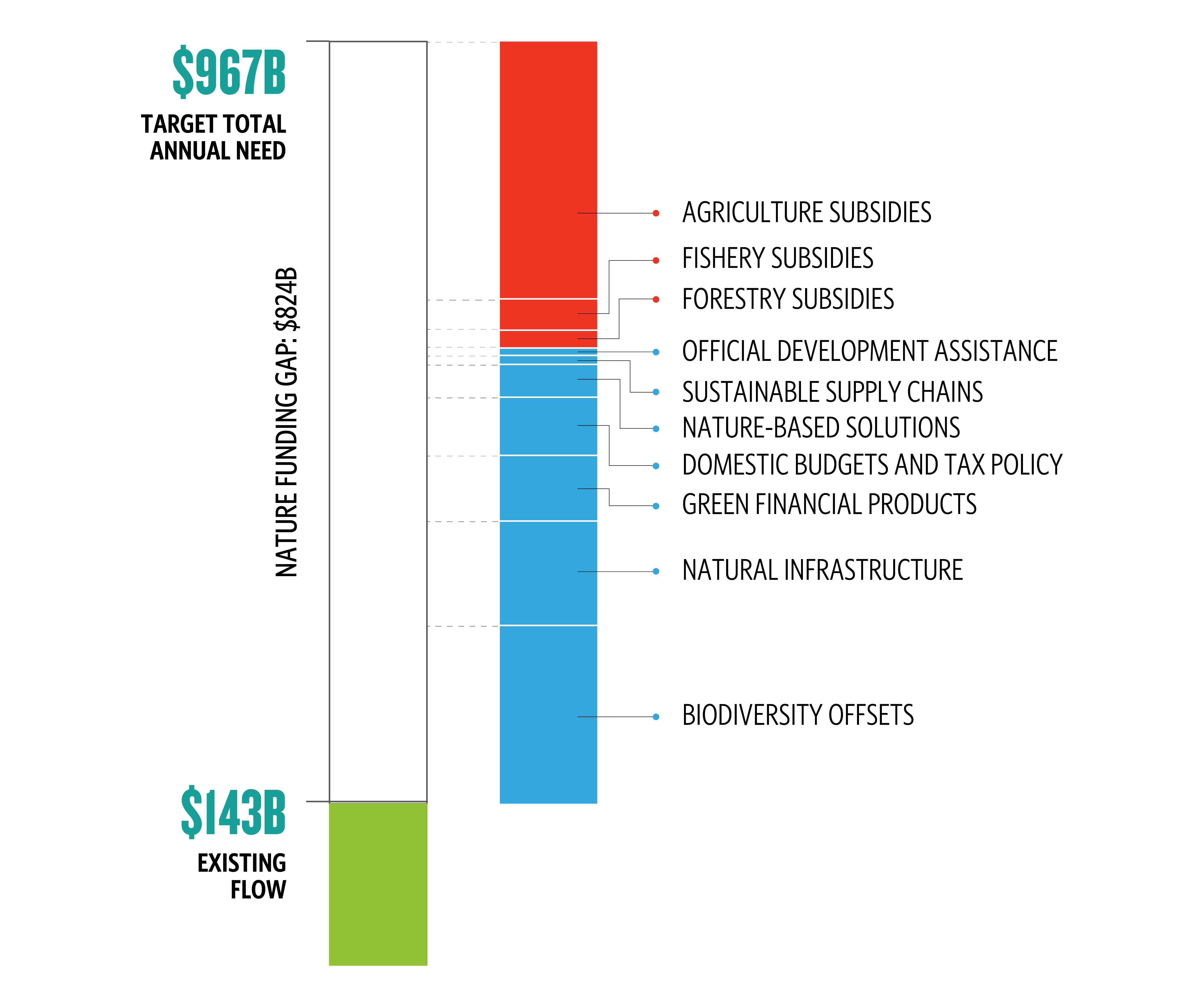

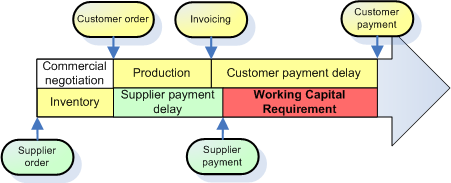

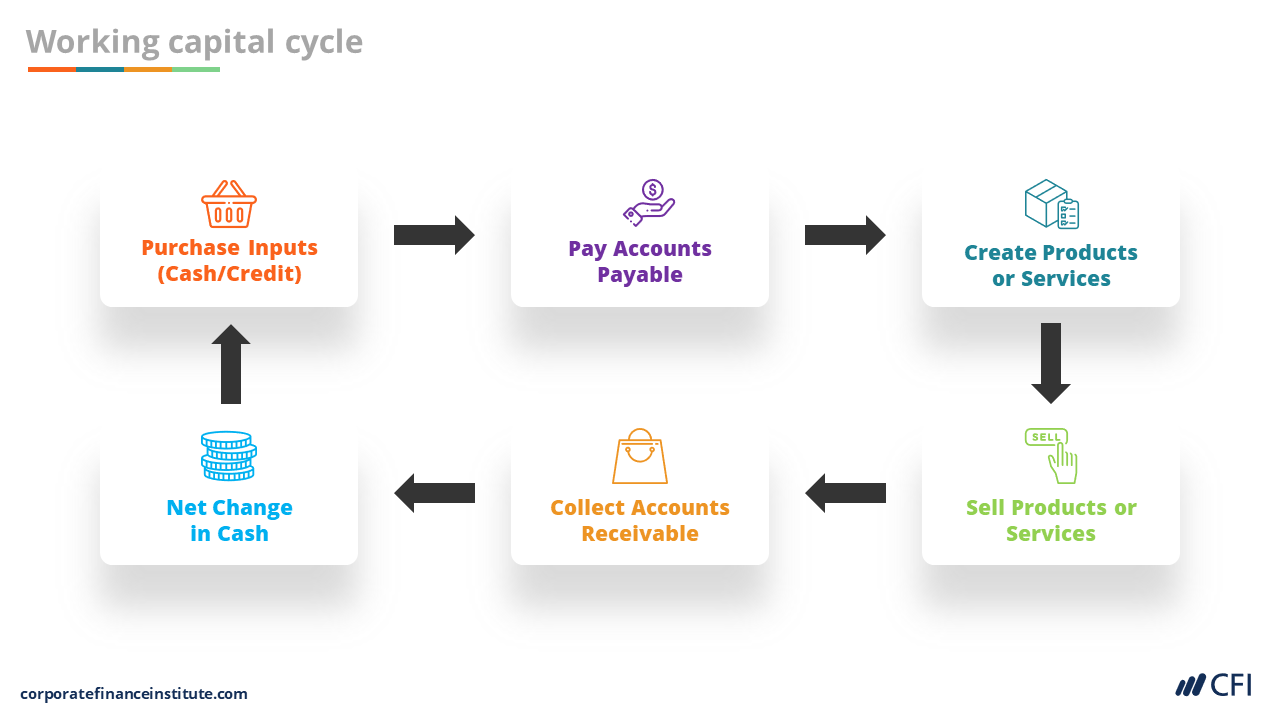

The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. Working capital funding gap refers to a gap that exists when the amount of money that is needed to fund ongoing operations or the future development of the business is not currently funded. Discuss the difference between a companys short-term operating cash flow and long-term investing cash flow.

Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off.

Vernimmen Corporate Finance Working Capital Requirement And Financial Debt Where To Draw The Line

Net Working Capital Guide Examples And Impact On Cash Flow

Shopify Capital How To Get A Shopify Loan To Scale Your Store

Closing America S Education Funding Gaps

What Are Positive And Negative Working Capital And Why They Re Important Brixx

The Cash Gap How Big Is Your Gap Cfo Simplified

Working Capital Formula How To Calculate Working Capital

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers

What Is Working Capital Meaning Definition Formula Management Net Working Capital And Example

Working Capital Requirement Formula Plan Projections

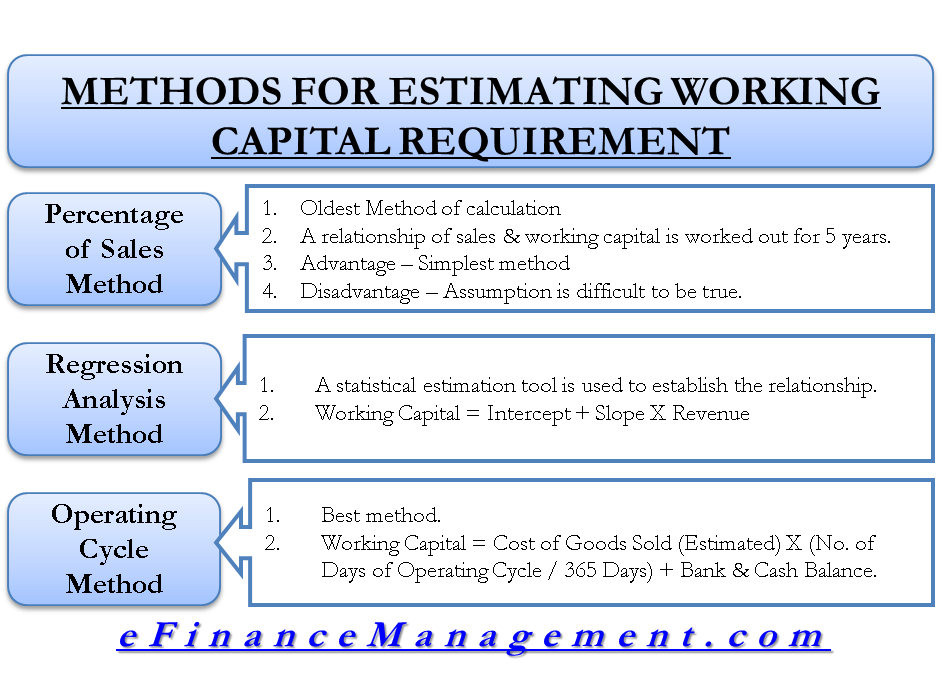

Methods For Estimating Working Capital Requirement

How To Improve Working Capital With Efficient Credit Management

Working Capital Cycle What Is It With Calculation

Cash Flow Cycles And Analysis I Finance Course I Cfi

How Start Up Capital Works Howstuffworks

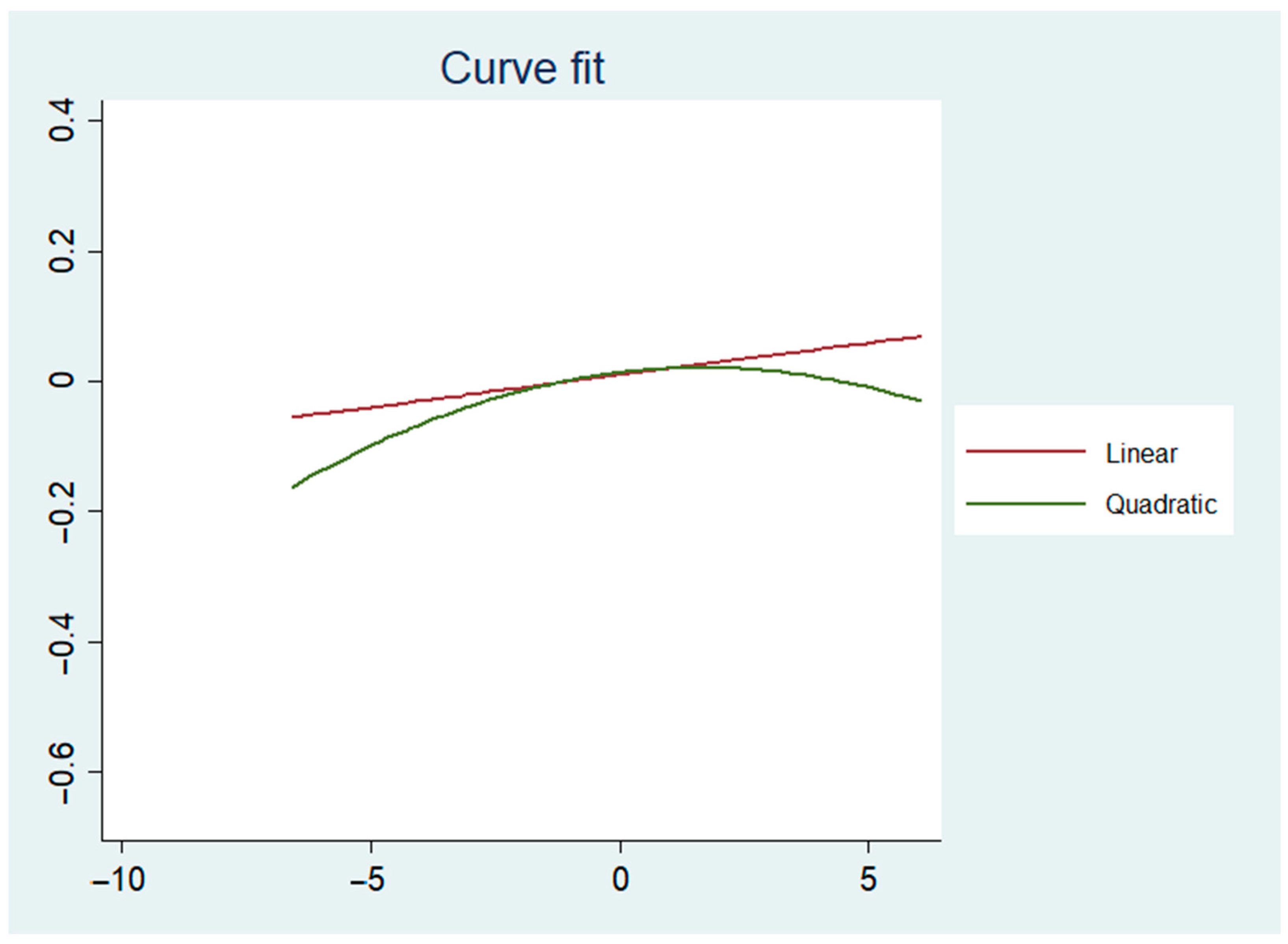

Jrfm Free Full Text The Impact Of Working Capital Management On Firm Profitability Empirical Evidence From The Polish Listed Firms Html

Solved Which Of The Following Items Are Not Included When Chegg Com

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)